Economic Sentiment Plateaus In The First Full Reading Of The Biden Administration

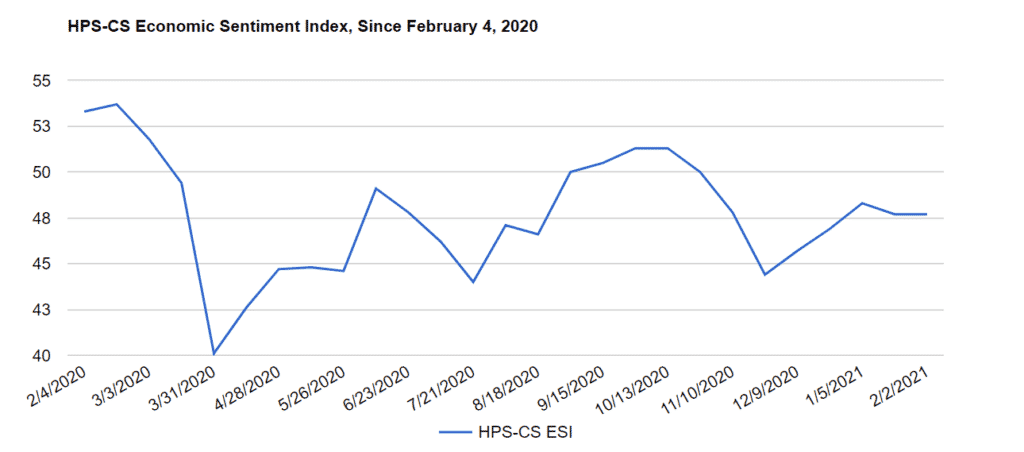

Economic sentiment held flat over the past two weeks, maintaining a reading of 47.7, according to the HPS-Civic Science Economic Sentiment Index (ESI). Despite bumps in confidence in the job market and U.S. economy, the reading was weighed down by a significant decline in Americans’ confidence in their personal finances.

Three of the ESI’s five indicators increased over the past two weeks. Climbing the most was confidence in the job market which rose 1.3 points to 41.0, returning to a level similar to that recorded before the most recent COVID surge. Confidence in the U.S. economy and making a major purchase also experienced slight upticks, increasing 0.8 and 0.5 points, to 50.9 and 42.5 respectively. Falling the most was confidence in personal finances, which dropped 1.9 points to 53.9. Despite the continued distribution of economic impact payments throughout January, confidence in personal finances has now fallen 3.4 points since the start of January. Confidence in the housing market also fell, declining 1.0 point to 50.2.

This is the first full ESI reading under the new Biden Administration, which has prioritized COVID-related policies such as increased vaccination distribution and advocating for another round of economic stimulus. The size and scope of the stimulus is still unclear as Republican Senators who met with President Biden on Monday have offered a smaller, trimmed down stimulus that could pass on a bipartisan basis, while Democratic leadership continues to support advancing a significantly more robust, likely partisan, stimulus package. Despite a litany of economic data showing that growth, and employment slowed in the Q4 of 2020, the Congressional Budget Office released some positive projections that U.S. growth will return to pre-pandemic levels later this year and employment may fall to 5.3 percent.

Despite the ESI’s level reading, the three-day moving average ticked upwards in the closing days of the period. The moving average began on January 20 at 49.8 and peaked the following day at 50.4 It then maintained a relatively steady decline to its low of 44.8 on January 30. The average closed the reading on an upswing, closing at 48.3 on February 2.

About the Index

The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures. For a more detailed overview of the Index and the underlying methodology, please request a white paper.

About CivicScience

CivicScience, Inc. provides the leading intelligent polling and real-time consumer insights platform, the InsightStore™. Its proprietary platform powers the world’s opinions and quickly gets that data to the decision makers who care. Every day, CivicScience polls ask millions of people questions related to thousands of topics, while its powerful data science and big data technology analyzes current consumer opinions, discovers trends as they start, and accurately predicts future behaviors and market outcomes. CivicScience polls run on hundreds of premier websites, in addition to its own public polling site at www.civicscience.com. CivicScience’s InsightStore™ is used by leading enterprises in marketing research, advertising, media, financial services, and political polling. For more information, visit CivicScience by clicking here and follow them on Twitter – @CivicScience.